Let's begin with the most obvious question. Let's look into what RSI Divergence means and what trading signals it could give. When the price action and RSI indicators aren't in line, a divergence is evident on the chart. The RSI indicator could make lower lows during downtrends, while the price action makes lower lows. A divergence is essentially when the indicator doesn't agree with the price action and when a situation similar to this occurs, you need to pay attention to the market. The chart clearly shows bullish RSI divigence as well as bearish RSI divigence. This is why the price action reversed immediately following each RSI divergence signal. Let's get to one last subject before we move to the thrilling topic. Follow the top crypto trading backtester for blog tips including automated crypto trading, automated trading bot, forex backtest software, trading platforms, forex backtesting software free, backtester, forex backtesting software, divergence trading forex, position sizing calculator, trading platform crypto and more.

What Is The Best Way To Analyze The Rsi Divergence?

We use the RSI indicator to help to recognize trends that have reversals. However, it is essential to determine the right trend reversal.

How Do You Recognize Rsi Divergence When Trading Forex

Both Price Action (RSI indicator) and Price Action (Price Action) did the same thing at the beginning of the trend by making higher highs. This indicates that the trend is stable. The trend ended with Price reaching higher levels at the conclusion. However, the RSI indicator was able to reach lower highs. This means that this chart is worth watching. This is the time to pay be watching the market as the indicator as well as the price action are not in of sync. This means there's an RSI deviation. In this example it is clear that the RSI divergence indicates an upward trend. Take a look below at the graph to observe what happened after the RSI Divergence. The RSI divergence can be extremely accurate when it is utilized to determine trends that are reversing. However, the issue is: how do you actually detect the trend reversal, right? Let's talk about four trade entry methods that offer greater chances of entry when used in conjunction with RSI divergence. See the top rated position sizing calculator for site examples including automated cryptocurrency trading, trading platform crypto, crypto trading bot, forex backtesting software free, online trading platform, bot for crypto trading, crypto trading, best trading platform, divergence trading forex, bot for crypto trading and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two variations of the triangle chart pattern are accessible. The ascending triangle pattern is utilized to reverse a downtrend. The descending Triangle pattern is used to reverse a trend in an uptrend. Take a look at the forex chart and see the downward circle pattern. Like the previous illustration it was moving up and then the price began to decrease. However, RSI also signals the divergence. These clues point out the weaknesses of this trend. We now know that the uptrend is losing its momentum. The price has formed a descending triangle pattern as a result. This confirms that the reverse is happening. It's now time to take action on the trade. The techniques for breakout used in this trade were the identical to the ones used previously mentioned. We will now look at the third trade entry method. This time, we'll blend trend structure with RSI diversgence. Let's look at how we can trade RSI diversion in the event that the trend structure changes. Read the best automated trading for site examples including trading platform cryptocurrency, RSI divergence, automated trading, crypto trading bot, backtesting platform, forex backtesting software free, crypto trading backtester, crypto trading backtesting, cryptocurrency trading, divergence trading and more.

Tip #2 – Combining RSI Divergence Pattern with the Head & Shoulders Pattern

RSI divergence is an instrument used by forex traders to spot market reverses. What happens if we combine RSI divergence along with other reversal factors such as the Head pattern? That will increase our chances of making a trade. Let's examine how to timing trades with RSI divergence combined with the pattern of head and shoulders. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading Strategy. Before we can think about a trade entry, we must be in a favorable market. The markets that are trending are the best as we are seeking a trend reversal. Take a look at the chart below. View the most popular best trading platform for site info including software for automated trading, crypto trading backtesting, crypto backtesting, crypto trading, backtester, best trading platform, forex backtesting, forex tester, RSI divergence, backtesting trading strategies and more.

Tip #3 – Combining RSI Diversity and Trend Architecture

The trend is our partner. The trend is our friend, so long as it's trending. However, we should trade in its direction. Professionals will show us. However, the trend isn't going forever, at some point it is going to reverse, isn't it? We will learn how to spot reversals quickly by observing the trend structure as well as the RSI Divergence. You've probably noticed that the trend upward is creating higher highs, while the downtrend is forming lower bottoms. Let's take a glance at the chart. If you take a look at the chart to the left, you'll notice that it's a downtrend. It has a series lows as well as higher highs. Next, have a take a look at the RSI divergence marked in the chart (Red Line). Price action can create Lows, but the RSI can also create higher lows. What's the meaning of all this? Despite the market creating low RSI This means that the current downtrend is losing its momentum. Read the top best crypto trading platform for blog tips including forex trading, automated forex trading, crypto trading bot, trading divergences, forex backtester, forex backtesting, automated trading, forex backtest software, forex backtester, best forex trading platform and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

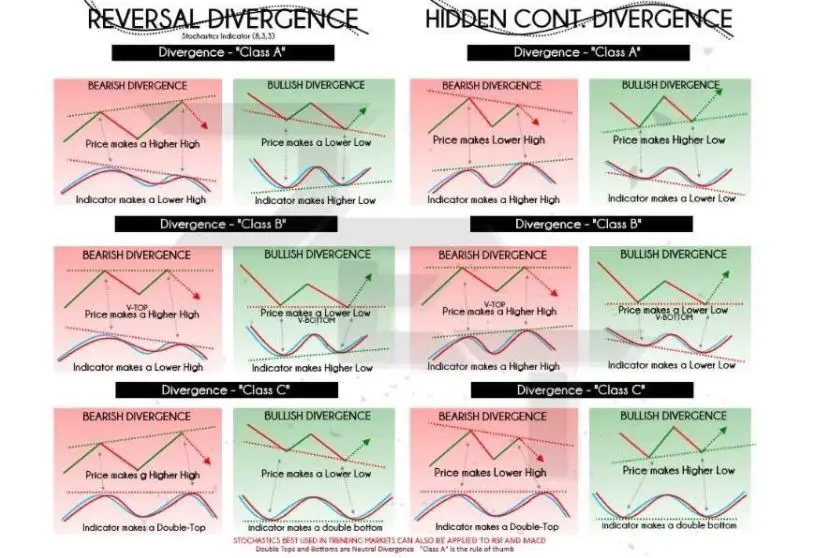

Double-bottom is a reversal chart that is formed after a long movement or an upward trend. The double top is the first top is formed when the price is at the level at which it cannot be broken. Once it has reached that point then the price will move lower slightly but then return back to test the previous level again. If the price bounce from the level once more, then there is double top. Below is the double top. The double top shows double top that both tops were created following a powerful move. The second top was unable to rise above the previous one. This is a strong indication that the buyers are struggling to go higher. The same set of principals applies to the double bottom as well however in a different way. We employ the breakout trading strategy. We initiate selling when the price drops below the threshold. The price broke below the trigger line, and we made a sale within a day. QUICK PROFIT. Double bottom requires the same trading techniques. Look at this chart to see the best way you can trade RSI divergence and double bottom.

Keep in mind that this is not the perfect all trading strategy. There is no perfect trading strategy. Every trading strategy has losses and they are inevitable. This trading strategy makes us steady profits, however we make use of strict risk management and a method to minimize our losses rapidly. That will reduce our drawdown which can allow for huge upside potential.